A version of a proposal put forth by the Greater San Diego Association of REALTORS® President Bob Kevane nearly 10 years ago may finally be given its chance to become law. At their recent Fall business meeting in San Diego the week of October 9, the Board of Directors for the California Association of REALTORS® (C.A.R.) voted to place the property tax portability proposal on the 2018 ballot.

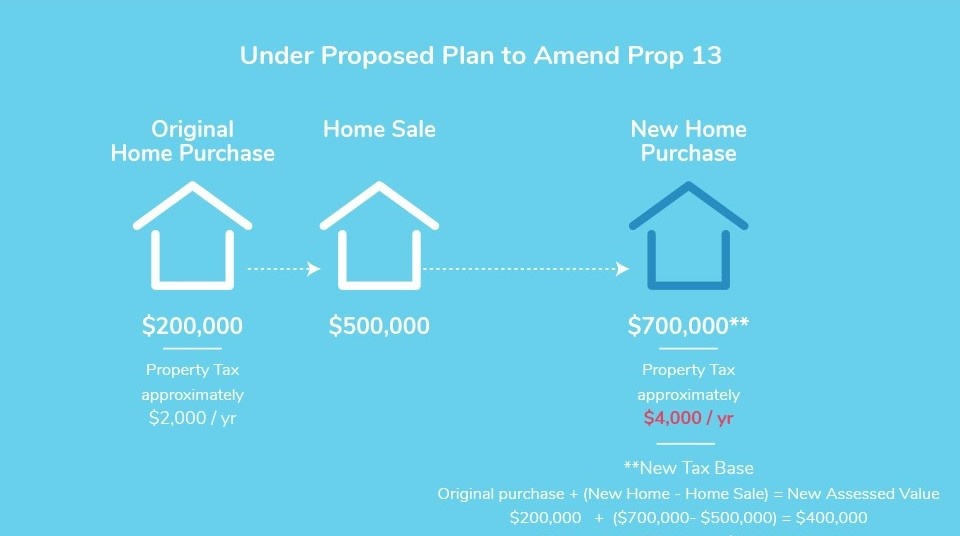

The plan, which would apply to homeowners aged 55 and older, would allow transfer of a homeowner’s existing property tax basis on their primary residence to a new primary residence anywhere in California. Homeowners would be able to do this an unlimited number of times. During instances in which the new home is of greater value, the proposal would allow for a blended valuation in which their existing tax basis would carry over to the new home with an additional amount applied based on the difference between the sales price of their new and existing home (see below diagram for details).

What are the benefits of this proposal?

This proposal is viewed by many as a win-win-win for existing homeowners, prospective homebuyers and localities that rely on property and other tax revenues (more to come on this). Among other benefits, the proposal would help to eliminate or at least reduce the well documented “Lock-In Effect” resulting from Proposition 13. This would help to free up housing stock at various price-points and create a move-up market benefiting growing families, seniors and even first-time homebuyers. In fact, the California Legislative Analyst’s Office estimates the proposal will result in approximately 43,000 additional transaction annually.

What are the next steps?

According to C.A.R., collecting the signatures required to place this proposal on the ballot will cost an estimated $3 million, with a supporting statewide campaign costing between $30 and $50 million. In an effort to fund this initiative, C.A.R. Directors voted to impose a $100 increase in the Issues Action Fund for every member as part of the 2018 dues billing cycle. Members can expect to receive additional information from C.A.R. and SDAR in the weeks ahead.

Related Articles

http://www.sandiegouniontribune.com/business/growth-development/sd-fi-prop13-story.html

http://www.sacbee.com/news/politics-government/capitol-alert/article175792866.html